ZealMint

From spends to strategy. Full expense control.

Automate AI workflows, enforce compliance, and unlock real-time insights. All in one place.

How We Transform Your Expense Stack

From manual expense chaos → intelligent financial control in minutes

Create Custom Workflows

Define & Enforce Policies

Execute Seamless Payouts

Detect Anomalies Instantly

Deliver CFO-Ready Insights

Get to know ZealMint

One platform. Zero manual work. Full control over spend.

ExpensePilot

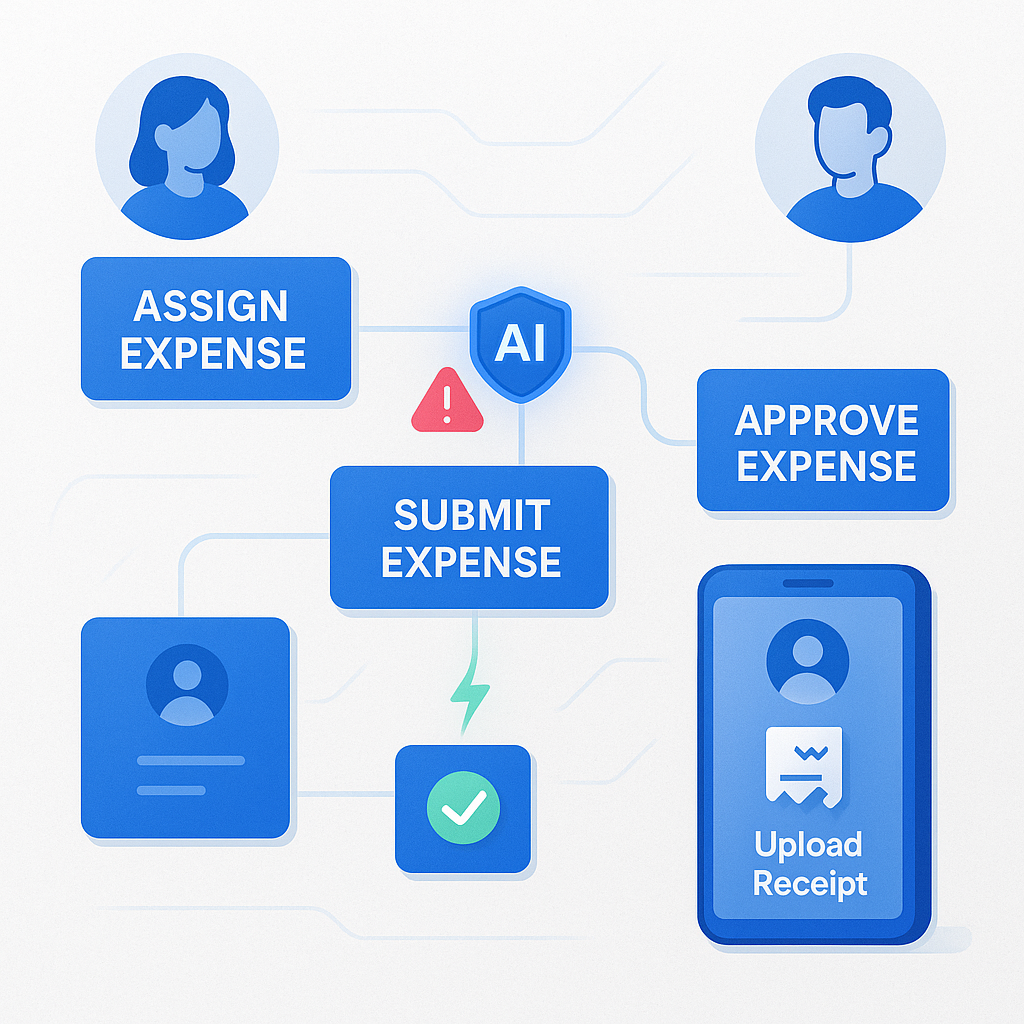

No-Code AI Workflows

- Design workflows, no code

- Tailored to each team

- Built-in AI validations

- Instant payouts

SmartScan

Invoice & Receipt AI

- OCR + GL tagging

- AI-based policy checks

- Supports all doc types

- Ensures accurate records

FuelGuard

Smarter Fuel Controls

- Validates mileage via GPS

- Auto-detects fuel fraud

- Enforces vehicle limits with mileage

- Reduces fuel costs

CFO Finsight

Real-Time Financial Insights

- Live dashboards & trends

- Project-level visibility

- Budget drift detection

- Predictive budget insights

Connect Everything

Our SaaS platform that seamlessly integrates with all your favorite tools. Boost productivity and streamline your workflow in one unified experience.

Slack

Communication

Google Workspace

Productivity

Microsoft Teams

Collaboration

Notion

Documentation

Zapier

Automation

Linear

Project Management

Figma

Design

GitHub

Development

Jira

Issue Tracking

Trello

Task Management

Asana

Workflow

Salesforce

CRM

HubSpot

Marketing

Stripe

Payments

Dropbox

Storage

Slack

Communication

Google Workspace

Productivity

Microsoft Teams

Collaboration

Notion

Documentation

Zapier

Automation

Linear

Project Management

Figma

Design

GitHub

Development

Jira

Issue Tracking

Trello

Task Management

Asana

Workflow

Salesforce

CRM

HubSpot

Marketing

Stripe

Payments

Dropbox

Storage

Slack

Communication

Google Workspace

Productivity

Microsoft Teams

Collaboration

Notion

Documentation

Zapier

Automation

Linear

Project Management

Figma

Design

GitHub

Development

Jira

Issue Tracking

Trello

Task Management

Asana

Workflow

Salesforce

CRM

HubSpot

Marketing

Stripe

Payments

Dropbox

Storage

Supercharge your financial operations.

Maximize every resource with AI-powered controls, compliance, and automations.

Spend Prevention & Compliance

Enforce spend policies at the source. Set smart rules by category, vendor, or amount and let ZealMint block out-of-policy spend before it ever happens.

Leakage & Fraud Control

AI monitors every transaction in real time flagging duplicates, policy violations, or unusual patterns. Detect fraud early, prevent cash leaks, and protect every spend.

Time & Effort Automation

Automate manual work like approvals, GL-tagging, and receipt matching. Free up your finance team to focus on strategy not spreadsheets.

Real-Time Visibility & Insights

Get live dashboards that show budget drift, project burn, and cash flow trends. Make faster, smarter decisions with always-updated financial data at your fingertips.

Auditability & Governance:

Every action is tracked, every transaction tagged. ZealMint keeps you audit-ready with clean logs, compliant records, and easy reporting no last-minute scrambling.

Stop guessing. Start controlling your spend with AI.

Join thousands of businesses that have transformed their spending decisions with intelligent insights and automated controls.